Fixed Deposits in companies that earn a fixed rate of return over a period of time are called Company Fixed Deposits.

The corporate fixed deposit is governed by section 58A of the Companies Act. Company fixed deposit is a good option for investment as they provide higher rate of interest compared to bank deposits.

They are a good source of regular income by means of monthly, quarterly, half-yearly, or yearly interest incomes. Performance of the company should be reviewed from time to time and at the maturity of deposit, by analyzing Balance Sheet & Share Prices movement. This will be helpful in deciding whether the deposit should be renewed or not.

BENEFITS

- Higher rates of interest.

- Flexible tenure ranging from 1 year to 10 years.

- Senior citizen benefits available.

- Prematurity clause is available.

- Loan Facility Available.

- Nomination facility available.

- No TDS in case the interest is only Rs. 5000 in one financial year.

- Regular interest incomes – Monthly, Quarterly, Half-yearly, or Yearly.

BONDS

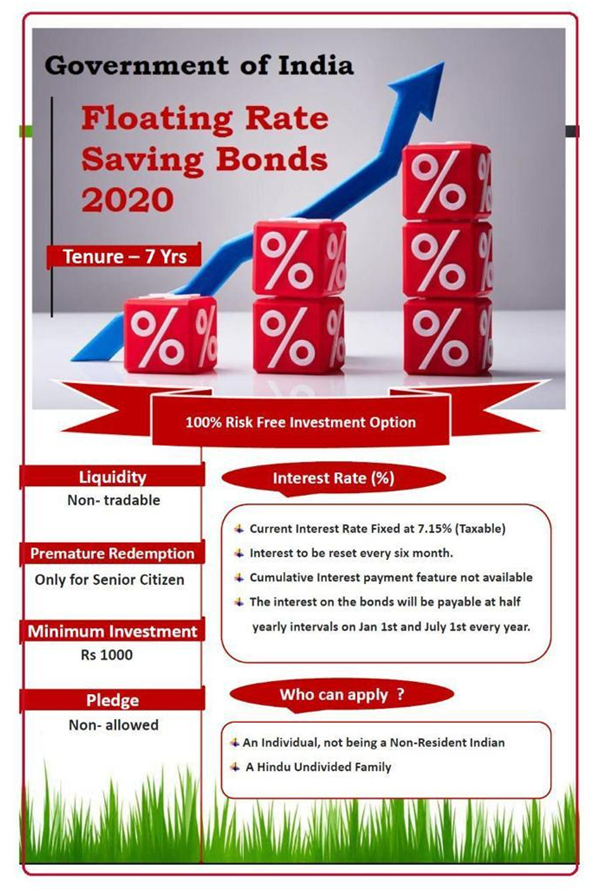

Floating Rate Savings Bonds 2020 (Taxable)

Government of India has decided to launch Floating Rate Savings Bonds 2020 (Taxable) scheme, with effect from July 01, 2020.